TSMC, Taiwan's semiconductor giant, has been a powerhouse in the tech world. The company’s net profit is a key indicator of its success.

Understanding TSMC's financial performance is crucial for investors and tech enthusiasts. TSMC plays a vital role in the global semiconductor industry. The company's net profit reflects its growth, innovation, and market position. This blog post will delve into TSMC's net profit, shedding light on the factors that drive it.

We will explore how TSMC's strategies, market demand, and technological advancements impact its financial outcomes. Whether you are an investor or simply curious, this overview will provide insights into TSMC’s impressive financial achievements. Let's dive into the numbers and what they mean for TSMC's future.

Credit: www.anandtech.com

Record-breaking Profits

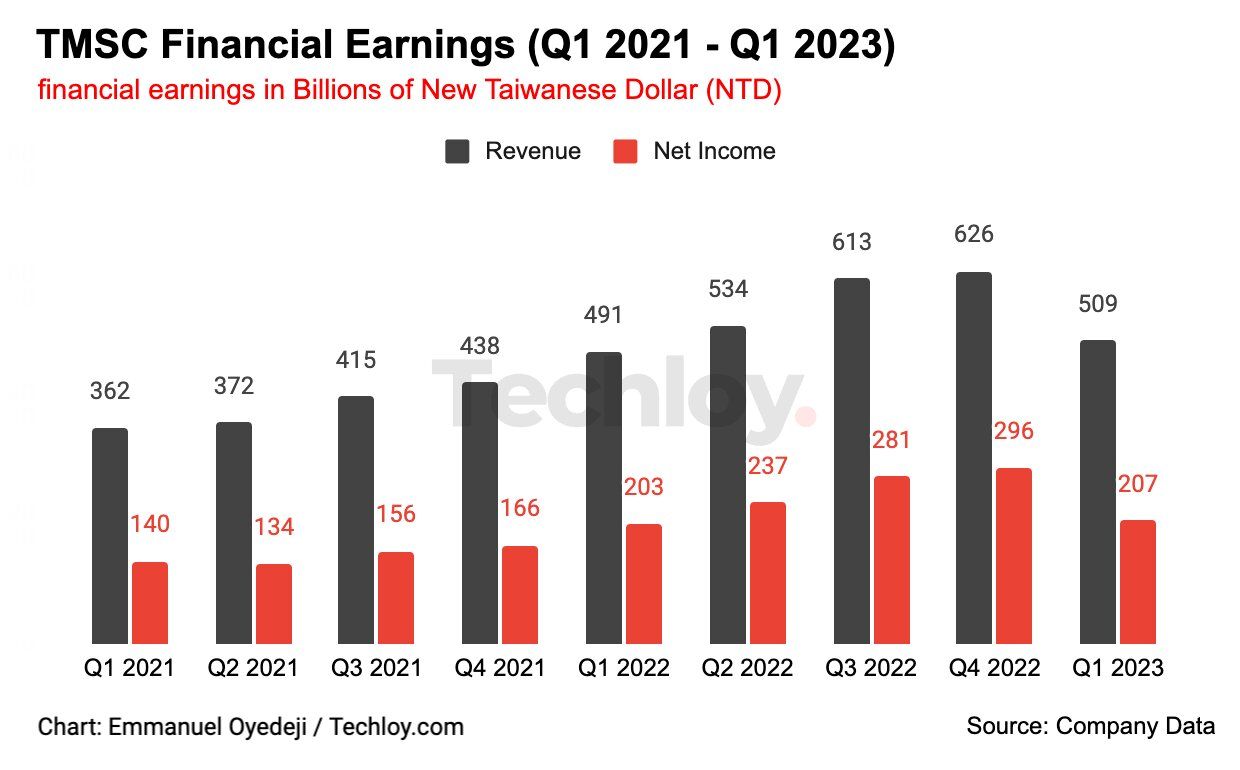

TSMC posted record-breaking profits this year. The company's net profit soared. Revenue increased significantly. This success is due to high demand for their chips.

Year-on-year growth showed a positive trend. Last year's profits were high, but this year’s are higher. The growth rate is impressive. TSMC leads in the semiconductor market. Their innovation keeps them ahead.

Credit: www.techloy.com

Key Drivers Of Profit Surge

High demand for semiconductors boosts TSMC's profit. Many industries need more chips. Phones, computers, and cars all use them. TSMC makes these chips. More demand means more sales. This leads to higher profits.

TSMC is expanding its factories. Bigger factories make more chips. More chips mean more sales. More sales increase profits. TSMC is investing in new machines. These machines are faster and more efficient. This helps TSMC produce more chips quickly. As a result, TSMC's profit goes up.

Impact On The Semiconductor Industry

TSMC's net profit has a big impact on the semiconductor world. More profit means more growth. They can invest in new tech. This helps them make better chips. Better chips mean more customers. More customers mean a bigger market share. A bigger market share boosts their position. They become a strong player in the market.

Other companies see TSMC's success. They try to compete. But TSMC has an edge. They have more funds. More funds mean better research. Better research leads to better products. This makes it hard for others to catch up. TSMC stays ahead. The competition must innovate or fall behind.

Credit: pr.tsmc.com

TSMC’s Strategic Investments

TSMC spends a lot on Research and Development (R&D). This helps them stay ahead. They create new chips every year. These chips are better and faster. TSMC's R&D budget is very high. This means they can hire the best people. They also buy the best tools. This helps them make the best products.

TSMC likes to try new things. They work on cutting-edge technologies. This includes things like 5nm and 3nm chips. These chips are small but powerful. They work fast and use less power. Many tech companies buy these chips. This helps TSMC make more money. They keep on improving their tech. This keeps them in the lead.

Challenges And Risks

Supply chain issues can affect TSMC’s net profit. Limited parts can delay production. Delays can lead to higher costs. Higher costs can reduce profit margins. TSMC’s must always manage inventory well. Good planning can help reduce these risks.

Economic changes can impact TSMC’s earnings. Slow economic growth can reduce demand for products. Lower demand can lead to lower revenues. Exchange rate changes can also affect profits. TSMC must stay aware of global market trends. Adapting strategies can help maintain profitability.

Future Outlook

TSMC aims to boost its production capacity in the next few years. New plants are planned in various countries. This will help meet the growing demand for advanced chips. More devices need powerful chips each year. TSMC sees a chance to grow its market share.

Investing in research and development is a key strategy. New technologies will keep TSMC ahead. Strong partnerships with big companies like Apple and Nvidia will continue. TSMC aims for steady profit growth.

Electric cars need many chips. TSMC can supply these. The demand for chips in healthcare is also rising. Medical devices use more advanced technology now. TSMC's chips can power these devices.

Smart homes and cities are becoming popular. They need reliable chips. TSMC can provide these. The company also sees potential in 5G technology. Faster networks need better chips. This is another chance for TSMC to grow.

Frequently Asked Questions

What Is TSMC's Net Profit In 2023?

TSMC's net profit in 2023 was significant, reflecting strong market demand. The company has consistently shown growth, showcasing its industry leadership.

How Does TSMC Achieve High Net Profit?

TSMC achieves high net profit through innovation, efficient manufacturing, and strong customer relationships. Their advanced technology nodes attract leading tech companies.

Why Is TSMC's Net Profit Important?

TSMC's net profit is important as it indicates financial health and industry influence. It also impacts shareholder value and market confidence.

What Factors Influence TSMC's Net Profit?

Factors influencing TSMC's net profit include market demand, technological advancements, operational efficiency, and strategic partnerships. These elements drive their financial success.

Conclusion

TSMC's net profit shows impressive growth. It reflects strong market demand and strategic planning. Investors find this growth promising. The company continues to lead in semiconductor manufacturing. Future prospects look bright for TSMC. Consistent performance boosts confidence among stakeholders. Profit trends indicate a robust business model.

TSMC remains a key player in the tech industry. Financial health remains strong, attracting more investors. The net profit results highlight TSMC's market dominance and innovation. Stay tuned for more updates on TSMC's financial journey.

.png)

0 Comments